5 Easy Facts About Stock Trading Shown

Table of ContentsThe Basic Principles Of Stock Trading The smart Trick of Stock Trading That Nobody is DiscussingThe 10-Second Trick For Stock TradingStock Trading Can Be Fun For Anyone

The fact is that purchasing the securities market lugs danger, however when approached in a regimented manner, it is among one of the most efficient methods to accumulate one's total assets. While the typical individual maintains a lot of their total assets in their house, the affluent and also very abundant generally have most of their wealth bought stocks.Owning stock suggests that a shareholder possesses a piece of the business equivalent to the number of shares held as a percentage of the firm's overall exceptional shares. For example, a private or entity that possesses 100,000 shares of a business with one million superior shares would have a 10% possession risk in it.

Stocks are also called shares or a business's equity. There are two primary sorts of supply: usual shares and chosen shares. The term equities is identified with usual shares, because their market price and also trading volumes are lot of times larger than those of recommended shares - stock trading. The major distinction in between the 2 is that typical shares usually lug ballot legal rights that allow the common investor to have a say in company conferences as well as elections, while preferred shares usually do not have ballot civil liberties.

Usual supply can be further categorized in terms of their voting legal rights. While the standard premise of common shares is that they should have equivalent ballot rightsone vote per share heldsome firms have dual or multiple courses of stock with various voting civil liberties connected to each course.

The Single Strategy To Use For Stock Trading

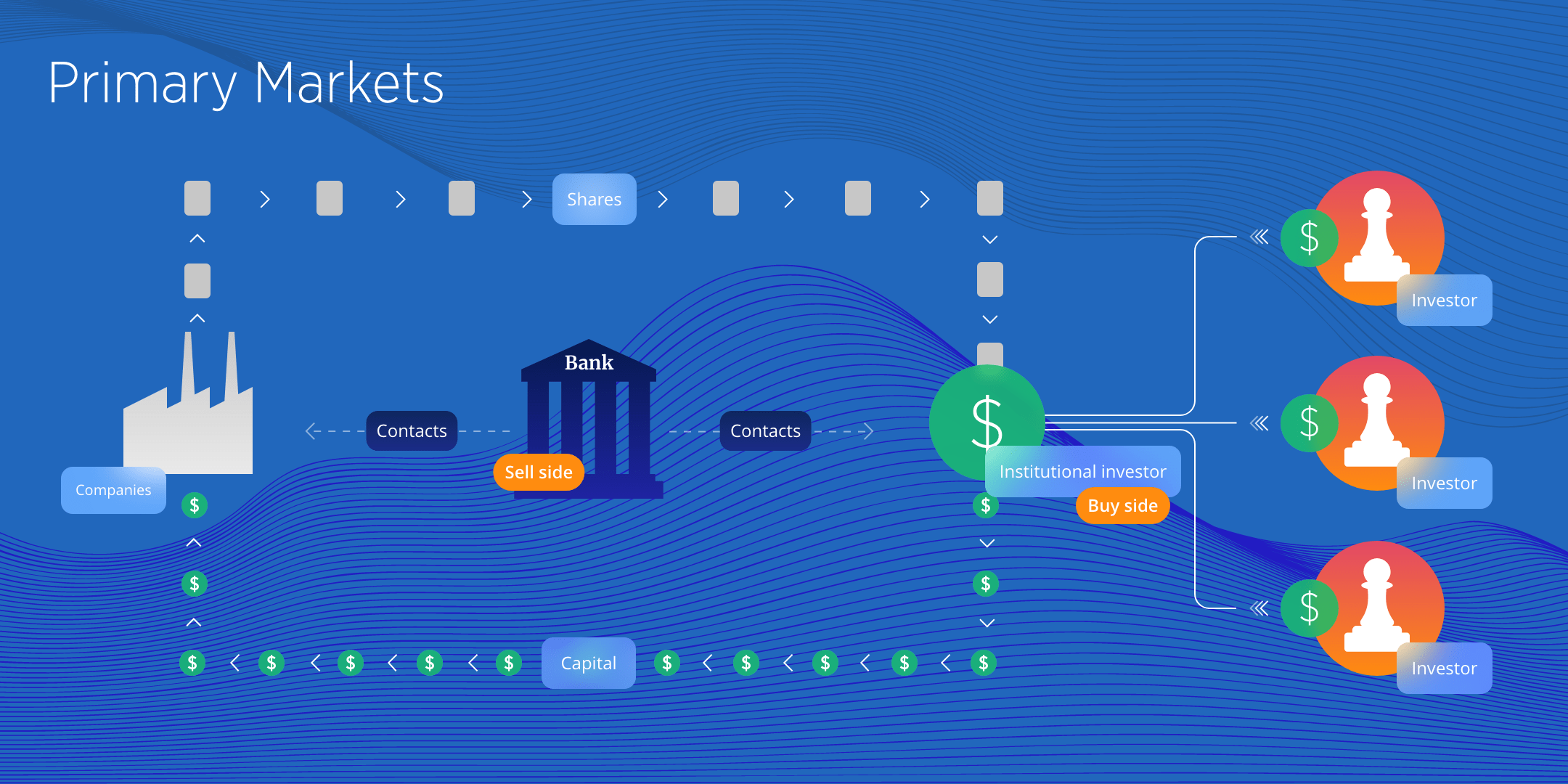

This changes the status of the firm from a private company whose shares are held by a few investors to a publicly-traded company whose shares will be held by many participants of the public. The IPO additionally offers very early investors in the firm an opportunity to cash out part of their stake, typically reaping very handsome rewards while doing so.

Business may take part in stock buybacks or provide brand-new shares but these are not day-to-day procedures and also typically take place outside of the structure of an exchange. When you purchase a share of stock on the supply market, you are not buying it from the business, you are getting it from some various other existing investor.

Getting My Stock Trading To Work

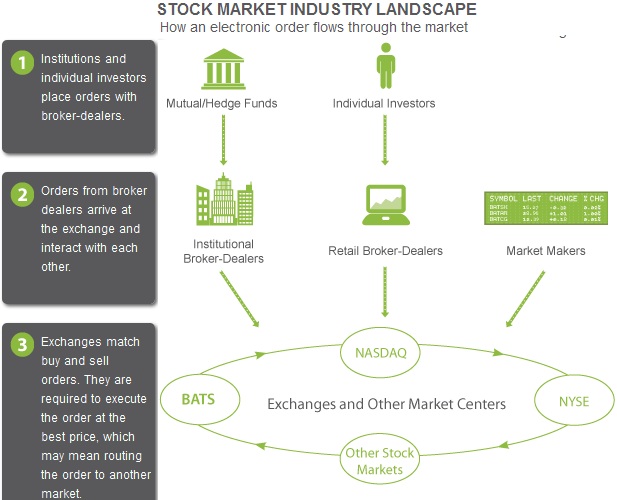

Today, there are lots of supply exchanges in the U.S. and throughout the globe, numerous of which are linked with each other digitally. (OTCBB).

Larger exchanges may need that a business has actually been in operation for a specific quantity of time before being detailed which it meets particular problems pertaining to business worth as well as success. In the majority of established nations, supply exchanges are self-regulatory organizations (SROs), non-governmental companies that have the power to create as well as apply industry laws as Source well as criteria.

Examples of such SRO's in the united state consist of specific stock exchanges, in addition to the National Organization of Securities Dealers (NASD) as well as the Financial Industry Regulatory Authority (FINRA). The costs of shares on a stock market can be embeded in a variety of methods. The most typical means is with an public auction procedure where buyers and also vendors place bids as well as offers to buy or offer.

When the quote and also ask synchronize, a trade is made. The overall market is comprised of countless investors and investors, that might have varying suggestions about the worth of a certain stock as well as therefore the rate at which they agree to buy or offer it. The countless transactions that happen as these financiers and also investors convert their objectives to actions by buying and/or offering a stock reason minute-by-minute revolutions in it over the program of a trading day.

The 9-Minute Rule for Stock Trading

For the average individual to get access to these exchanges, they would need a financier. stock trading. This stockbroker functions as the middleman in between the customer as well as the vendor. Getting a financier is most commonly accomplished by creating an account with a reputable retail broker. The supply market additionally supplies a fascinating instance of the legislations of supply and also need at the office in real-time.

Due to the immutable regulations of supply as well as need, if there are extra purchasers for a specific stock than there are sellers of it, the supply rate visit the site will trend up. Conversely, if there are more sellers of the supply than customers, the price will trend down (stock trading). The bid-ask or bid-offer spread (the difference in between the proposal rate for a supply as well as its ask or use cost) represents the distinction in between the highest possible rate that a purchaser agrees to pay or bid for a stock and also the most affordable rate at which a seller is providing the supply.

If buyers outnumber vendors, they may agree to raise their bids in order to obtain the stock. Sellers will, as a result, ask greater costs for it, ratcheting the price up. If sellers outnumber buyers, they may be eager to approve lower offers for the stock, while purchasers will likewise lower their bids, efficiently requiring the price down.